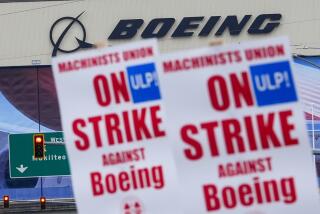

Boeing withdraws contract offer after talks with striking workers break down

Boeing has withdrawn a contract offer that would have given striking workers 30% raises over four years after talks broke down.

The manufacturer said that it had boosted its offer for union workers for take-home pay and retirement benefits during two days of negotiations.

“Unfortunately, the union did not seriously consider our proposals. Instead, the union made non-negotiable demands far in excess of what can be accepted if we are to remain competitive as a business,” Boeing said in a prepared statement. “Given that position, further negotiations do not make sense at this point and our offer has been withdrawn.”

The union said that it surveyed its members after receiving Boeing’s most recent offer, and it was rejected overwhelmingly.

“Your negotiating committee attempted to address multiple priorities that could have led to an offer we could bring to a vote, but the company wasn’t willing to move in our direction,” the International Assn. of Machinists and Aerospace Workers District 751 said in a message to members.

The union complained last month that Boeing had publicized its latest offer to 33,000 striking workers without first bargaining with union negotiators.

The offer was more generous than the one that was overwhelmingly rejected when the workers went on strike Sept. 13. The first proposal included 25% raises. The union originally demanded 40% over three years. Boeing said average annual pay for machinists would rise from $75,608 now to $111,155 at the end of the four-year contract.

The union represents factory workers who assemble some of the company’s best-selling planes.

The strike is stretching on as Boeing deals with multiple other issues. It has shut down production of 737s, 777s and 767s. Work on 787s continues with nonunion workers in South Carolina.

S&P Global Ratings put Boeing Co. on its “CreditWatch Negative” list this week, citing increased financial risk because of the strike.

“We estimate the company will incur a cash outflow of approximately $10 billion in 2024, due in part to working capital buildup to support manufacturing process overhaul and costs associated with the strike,” S&P wrote.

The addition to S&P’s CreditWatch means there is an increased likelihood of a credit downgrade, which could make it more expensive for the company to borrow money.

Shares of Boeing, which is headquartered in Arlington, Va., fell almost 3% at the opening bell Wednesday and the stock is down 41% this year.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.